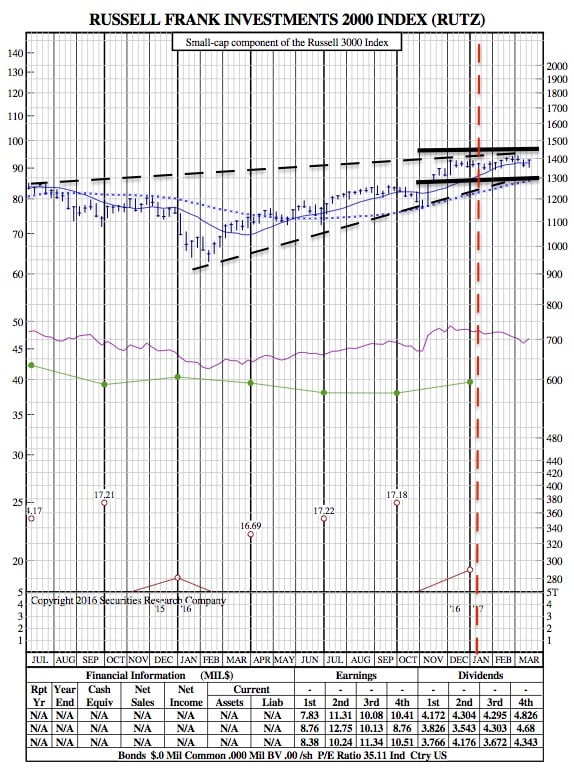

Why shares of Smaller Companies are Lagging behind the Market in 2017 (Russell 2000 21-Month Chart)

WSJ — The small-cap rally that took Wall Street by storm late last year has petered out.

Shares of smaller companies have lagged behind the market this year, underscoring investor concern over the likely timing of economic-policy changes by President Donald Trump’s administration and rising U.S. interest rates.

The Russell 2000 index of small-capitalization companies is up 2.5% this year, while the S&P 500 is up 6.2%. Small-caps rose 14% between Election Day (noted below in red) and the end of 2016, while the S&P 500 climbed 4.6% over the same time frame.

Russell 2000 21-Month Chart:

Some analysts say small-caps’ recent sluggishness is a sign of investor skepticism that Mr. Trump and Republicans in Congress will be able to quickly enact promised tax cuts and infrastructure spending measures. Those plans tend to benefit smaller, more domestically-focused companies rather than larger multinationals.

“There’s some disappointment being priced into the markets around delayed tax reform, which small companies are more vulnerable to,” said Jim McDonald, chief investment strategist at Northern Trust, which manages about $942 billion in assets.

Mr. McDonald said further delays in passing tax cuts could lead many investors to sell these stocks.

Shares of Tutor Perini Corp., a construction company based in Sylmar, Calif., are up 7.9% this year after surging 41% between Election Day and the end of 2016. Last month, the company reported fourth-quarter earnings of 60 cents a share, in line with analysts’ estimates. Shares of Celadon Group, an Indianapolis trucking firm, are up 5.6% in 2017 after running up 32% over the same period last year. The company reported quarterly earnings in February that beat analysts’ expectations.

Smaller stocks could continue to trail behind for other reasons. Higher financing costs as the Federal Reserve raises rates are likely to disproportionately affect smaller companies.

Small companies’ debt burden has grown at a faster clip than that of medium and large companies when compared with earnings growth, said Dan Suzuki, an equity strategist at Bank of America Merrill Lynch. He found that small-caps have lagged behind shares of large U.S. companies in four of the past five rate-tightening cycles since 1987.

Since 1925, small-cap stocks have gone through long bull and bear markets that can last a decade or more, Mr. Suzuki said. So far, small-caps are only about five years into a period where they have lagged behind large ones, raising the question of whether the postelection jump was just a transitory blip.

Yet many analysts say the fate of these smaller companies in the months ahead may be most closely tied to the prospects for Mr. Trump’s pro-business proposals.

Smaller U.S. companies that do most of their business at home pay higher effective tax rates than multinational companies, meaning they would stand to benefit more from prospective corporate-tax cuts.

Mr. Trump has pledged to renegotiate major trade agreements, a move that could hurt sales for the big exporters but wouldn’t affect domestically oriented companies much. Smaller companies also would be less affected by a rising dollar that could accompany a stronger U.S. economy and make big exporters less globally competitive.

The small-cap rally was followed by a rise in bullish bets on these stocks. Speculative long positions in Russell 2000 index futures surged to a record of 209,000 contracts during the first week of 2017, according to the Commodity Futures Trading Commission.

But long positions dwindled to 141,000 by March 14 as investors pulled out and speculative shorts surged. Bearish futures contracts have jumped to 166,000, the highest since 2008.

“The first move higher was euphoria and a lot of hedge-fund buyers fueled the run-up in small-caps,” said Mike O’Rourke, chief market strategist at JonesTrading Institutional Services. “What you’re seeing now with the pullback is a feeling that the honeymoon is over, kind of an ‘uh, oh, things are going to take longer than we thought.’ ”

Some analysts are growing skeptical that a tax cut will pass this year. Even with control of Congress, Republicans disagree on the architecture and details of plans to overhaul the tax code.

For instance, House Speaker Paul Ryan (R., Wis.) and Senate Majority Leader Mitch McConnell (R., Ky.) both say they don’t want the tax plan—with some caveats—to add to budget deficits. President Trump’s campaign plan didn’t meet that test and he is still promising huge tax cuts.

Republicans for procedural reasons also have put the tax bill behind the health-care overhaul, which is dividing lawmakers.

Tony Roth, chief investment officer at Wilmington Trust, said traction on health care is a critical test of whether the administration can push through other big policy changes as quickly as markets expect.

“Trump’s agenda, overall, is more beneficial to small-caps and the fact that the market has discounted them shows that patience is needed until tax reform is on the table,” he said.