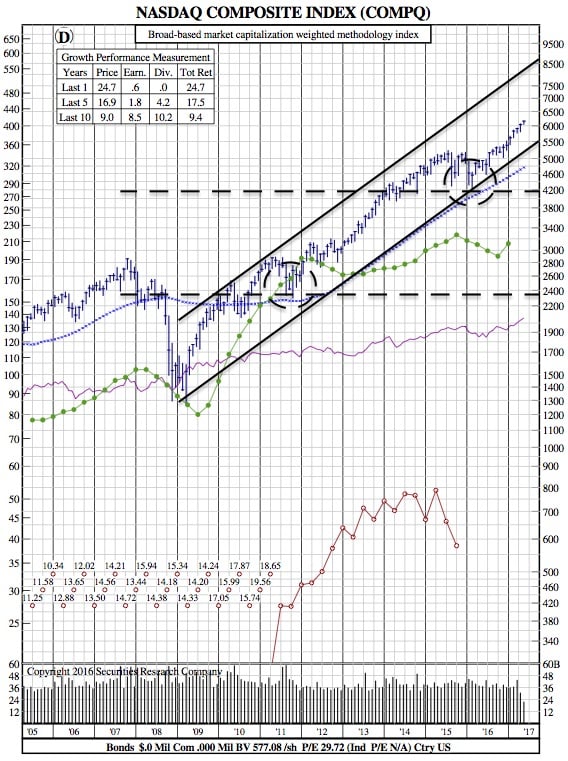

May 19th, 2017: A Week In Review (Nasdaq Composite 12-Year Chart)

Reuters — U.S. stocks were higher late Friday morning as a set of strong corporate earnings lifted investor spirits in a week dominated by uncertainty surrounding Donald Trump’s presidency.

Reuters — U.S. stocks were higher late Friday morning as a set of strong corporate earnings lifted investor spirits in a week dominated by uncertainty surrounding Donald Trump’s presidency.

However, Wall Street’s major indexes were on track for their worst weekly declines since mid-April following reports that Trump had tried to interfere in a federal investigation.

Investors were concerned that the uncertainty in Washington could hinder Trump’s promise of fiscal stimulus, a bet on which Wall Street has rallied to record highs.

Strong quarterly earnings from companies, including Autodesk (ADSK.O) and Deere & Co (DE.N), boosted the market. Autodesk was among the biggest percentage gainers on the S&P and the Nasdaq after the software maker reported better-than-expected quarterly revenue.

Deere hit an all-time high of $122.24 after the farm and construction equipment maker reported a quarterly profit that beat expectations.

The news lifted Caterpillar’s (CAT.N) shares by 2 percent, making it the top stock on the Dow.

“We think the Trump trade and the reflation trade have unwound almost entirely post-election, and the market is relying on a recovery in earnings and strong fundamentals,” said Matt Jones, U.S. head of equity strategy, J.P. Morgan Private Bank.

Of the 452 S&P 500 companies that have released results so far, about 75 percent have topped earnings expectations. In a typical quarter, about 64 percent beat estimates, according to Thomson Reuters I/B/E/S.

“You (also) didn’t have a lot of news out of Washington, which is helping calm some of the anxiety,” Jones said.

At 11:09 a.m. ET, the Dow Jones Industrial Average (.DJI) was up 122.39 points, or 0.59 percent, at 20,785.41, the S&P 500 (.SPX) was up 17.5 points, or 0.74 percent, at 2,383.22 and the Nasdaq Composite (.IXIC) was up 43.57 points, or 0.72 percent, at 6,098.70.

$COMPQ 12-Year Chart:

All the 11 major S&P 500 sectors were higher, with industrials (.SPLRCI), materials (.SPLRCM) and energy (.SPNY) gaining more than 1 percent.

All the 11 major S&P 500 sectors were higher, with industrials (.SPLRCI), materials (.SPLRCM) and energy (.SPNY) gaining more than 1 percent.

Oil rose more than 2 percent, helping energy shares, amid talks of an extension to the supply limit deal among OPEC members.

Wal-Mart (WMT.N) was up 1.7 percent at $78.86 after BMO upgraded the big-box retailer’s stock to “market perform” from “underperform” following higher-than-expected quarterly sales at established U.S. stores.

Advancing issues outnumbered decliners on the NYSE by 2,194 to 596. On the Nasdaq, 1,776 issues rose and 890 fell.

The S&P 500 index showed 17 new 52-week highs and eight new lows, while the Nasdaq recorded 57 new highs and 39 new lows.