Is it Time to Abandon Kroger after the Amazon Blow? (21-Month Chart)

Bloomberg — Kroger Co. was already in trouble last week — and then Amazon said it would buy Whole Foods.

The biggest U.S. supermarket chain lost more than $7 billion in market value combined on Thursday and Friday, the biggest two-day loss for the company since December 1999. The 19 percent plummet on Thursday was thanks to a lousy earnings report. The 9 percent drop the next day was courtesy of Amazon.com Inc.’s announcement about acquiring Whole Foods Market Inc. If Amazon pulls that deal off, the competition will be even more cutthroat in an industry known for razor-thin profit margins.

And Kroger has been struggling, battered by a record bout of food deflation. It has spent several years lowering prices and focusing on fresh produce in a bid to thwart giant Wal-Mart Stores Inc., which generates more than half of its revenue from groceries. The question is how it will fare having to fend off not only the world’s largest brick-and-mortar chain but also the undisputed king of internet retailing.

“They were expecting a long protracted battle — now it’s a knife fight,” said Matt Sargent, who studies retailers at the consumer research firm Magid.

Kroger’s stock tumble also weakens its position if the company were to seek its own deal. Any counterbid for Whole Foods would be all the more difficult after last week’s 28 percent decline. Instead, the company may need to merge with European giant Royal Ahold Delhaize NV, according to Sanford C. Bernstein analyst Bruno Monteyne. Ahold Delhaize already owns the Food Lion and Stop & Shop chains in the U.S.

Amazon also could put pressure on Kroger to bolster its technology. The supermarket chain has already has been investing in a so-called “click-and-collect” system, which allows customers to order online and pick up their groceries at a store. That service is available at more than 600 stores and was seen as Kroger’s bid to protect itself against the slow rise of e-commerce in the food industry. If the Amazon deal goes through, that program will be put to the test.

Even before the Amazon announcement, Kroger’s poor performance was raising concerns on Wall Street. The Cincinnati-based company on Thursday reported its second straight quarter of declining same-store sales, the worst slump in at least 13 years. The chain also cut its profit forecast, citing rising health-care and pension costs. That led to credit downgrades, and the pessimism reverberated to grocery competitors.

Falling Prices

Kroger faces more immediate concerns than a potential battle with Amazon. The price of groceries has dropped for 17 straight months, the longest streak in more than 60 years. Lower food prices, while a boon to consumers has brought headaches to supermarkets. The situation has led Wal-Mart and other retailers to offer steeper discounts to boost customer traffic. The resulting price war has weighed on profit margins.

The price battle with Wal-Mart has hurt Kroger, according to Chris Mandeville, an analyst at Jefferies.

“This has clearly not been a winning strategy,” he said in a research note.

Not everyone has such a dire outlook, though. Jennifer Bartashus, an analyst at Bloomberg Intelligence, said that in addition to technology investments, Kroger has a strong base of customers across the U.S., including suburban areas outside of the big-city markets where Whole Foods is strongest.

“The immediate impact is not as strong as the market’s initial reaction would have people believe,” she said. “Kroger has been investing for this day. I’m not saying they’re going to win the battle, but they’re not starting from nothing.”

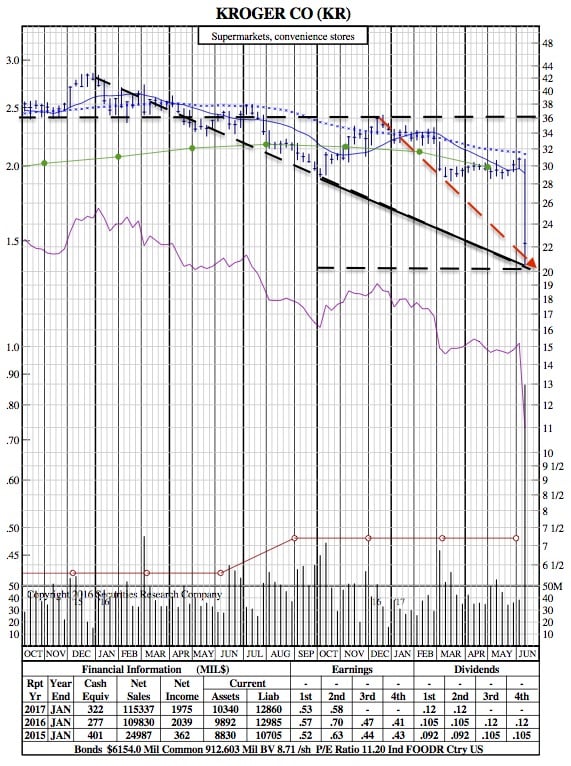

$KR 21-Month Chart: